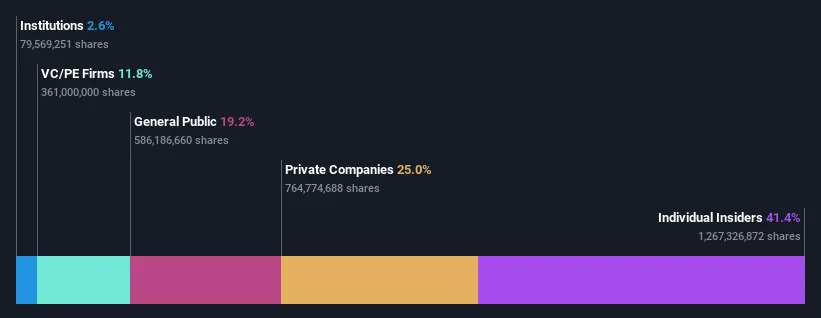

Every investor in Swiss Steel Holding AG (VTX:STLN) should be aware of the most powerful shareholder groups. We can see that individual insiders own the lion’s share in the company with 41% ownership. Put another way, the group faces the maximum upside potential (or downside risk).

With such a notable stake in the company, insiders would be highly incentivised to make value accretive decisions.

Let’s delve deeper into each type of owner of Swiss Steel Holding, beginning with the chart below.

View our latest analysis for Swiss Steel Holding

What Does The Institutional Ownership Tell Us About Swiss Steel Holding?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

Since institutions own only a small portion of Swiss Steel Holding, many may not have spent much time considering the stock. But it’s clear that some have; and they liked it enough to buy in. So if the company itself can improve over time, we may well see more institutional buyers in the future. When multiple institutional investors want to buy shares, we often see a rising share price. The past revenue trajectory (shown below) can be an indication of future growth, but there are no guarantees.

Hedge funds don’t have many shares in Swiss Steel Holding. The company’s largest shareholder is Martin Haefner, with ownership of 41%. For context, the second largest shareholder holds about 25% of the shares outstanding, followed by an ownership of 12% by the third-largest shareholder.

After doing some more digging, we found that the top 2 shareholders collectively control more than half of the company’s shares, implying that they have considerable power to influence the company’s decisions.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. As far as we can tell there isn’t analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Swiss Steel Holding

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own a reasonable proportion of Swiss Steel Holding AG. Insiders own CHF261m worth of shares in the CHF630m company. We would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, who are usually individual investors, hold a 19% stake in Swiss Steel Holding. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Equity Ownership

Private equity firms hold a 12% stake in Swiss Steel Holding. This suggests they can be influential in key policy decisions. Some investors might be encouraged by this, since private equity are sometimes able to encourage strategies that help the market see the value in the company. Alternatively, those holders might be exiting the investment after taking it public.

Private Company Ownership

Our data indicates that Private Companies hold 25%, of the company’s shares. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it’s hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We’ve identified 2 warning signs with Swiss Steel Holding , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.